When it comes to lowering your taxes and easing the expenses associated with health care needs, health savings accounts (HSAs) are a cost-effective financial tool that can work hard for you and your family. If you don’t have one, it can be confusing to understand how an HSA can be an asset, and if you do, it can be easy to forget about the money that’s been accumulating and where to begin using it.

With open enrollment providing a new opportunity to adjust your benefits and financial health strategy, here are some reasons why you might want to consider choosing a plan with an HSA.

HSA 101: What is an HSA account and how can it benefit me?

HSA 101: What is an HSA account and how can it benefit me?

If you’re in need of an HSA explanation, you’re not alone. Reports show that over 65% of Americans are confused by the ins and outs of HSAs. Starting from the top, a health savings account is a savings account available through certain qualified high-deductible plans that lets you set aside pre-taxed money to use toward qualified medical expenses. Here are the main benefits of HSAs:

- Triple tax benefits. When it comes to HSAs, contributions go untaxed, the funds you save grow tax-free and when you need them, withdrawals for qualified medical expenses go untaxed, too.

- Take advantage of employer contributions. Surveys show that 83% of employers make contributions to HSAs. If you’re eligible for an HSA through an employer plan, check to see if your organization makes contributions.

- Save now, access later. Unlike a Flexible Spending Account (FSA), there’s no need to worry about losing your HSA funds if you don’t use them. HSA balances roll over year after year and are individually-owned, so they stay with you even if you change employers or health plans. If you change to a health plan with a different HSA partner, you can then roll over funds from your previous HSA.

- File for reimbursement when you’re ready. If your HSA was established prior to incurring a specific medical expense and you have the appropriate payment records, you can seek reimbursement for that expense at any point in the future.

- Save more in 2024. The IRS recently announced increased contribution limits for 2024: $4,150 for individual coverage, $8,300 for family coverage.

How can you make the most of your HSA?

How can you make the most of your HSA?

Here are some unexpected ways to use your HSA funds to help lower your out-of-pocket medical expenses and plan for the future:

Keep track of health care-related travel expenses.

Part of seeking medical care is getting yourself to and from appointments, and your HSA can work towards covering your travel expenses for medical care. Whether it be parking, a taxi/rideshare, train or flight – your funds not only go toward covering your own personal travel expenses, but they can also cover those traveling with you such as parents or caregivers.

Take advantage of family planning and postpartum care coverage.

An HSA can support the family planning process beyond standard prescription medications and exams. From pregnancy tests to fertility treatments, your HSA can work for you in numerous ways. For those who have given birth or are planning to, the IRS highlights reimbursements for a number of expenses beyond typical childbirth costs, such as medically-certified doulas and childbirth classes. For postpartum, an HSA can go a long way towards covering breastfeeding support such as pumps and supplies that assist with lactation.

Use for dental, vision, prescriptions and more.

Remember that your HSA can cover a variety of health care needs – including medical, dental and vision expenses. This ranges from routine visits all the way to prescriptions and potential procedures. Depending on your eligibility, your HSA can also be allocated towards certain mental health services including online therapy sessions, prescriptions and treatments.

What’s more, there are also other HSA-eligible items such as fitness trackers, medical alert gear or even sunscreen that your HSA can pay for when accompanied by an appropriate Letter of Medical Necessity (LMN). Remember to check for eligibility prior to taking action.

Invest and grow your contributions.

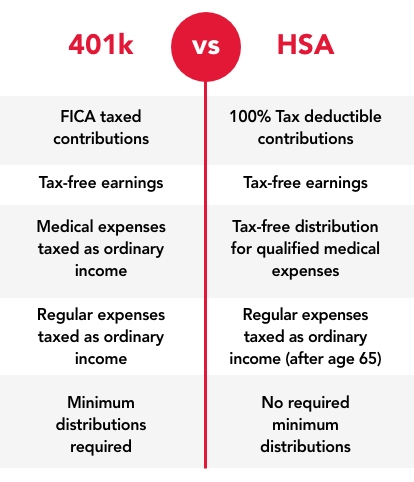

A survey by the Plan Sponsor Council of America showed that 84% of employers offer investment options for HSA contributions, however only 20% of participants invested assets in 2020. If you’re able to hold off on spending your HSA contributions, they can become a powerful investment to use toward health care expenses during retirement. HSA contributions can be invested into mutual funds, stocks or bonds, tax-free, can compound year after year and have exclusive benefits that can’t be accessed through a 401(k) or IRA.

Source: HealthEquity, 10 HSA Myths, Debunked

Source: HealthEquity, 10 HSA Myths, Debunked

Depending on your needs, an HSA can be a powerful tool for you and your family. If you’re a Harvard Pilgrim member and considering an HSA, MyHealthMath (available with eligible plans) is a decision-support tool that can help you understand the value of an HSA and if it’s right for you.