Members often have questions about their health plan, from the definition of terms to how to best utilize their coverage. Our Term Talk series aims to answer commonly asked questions to help you better understand health insurance and empower you to make decisions about your coverage that best fits your needs.

A common dilemma:

Open enrollment is coming up, and I want to be sure I’m making the best health care decision for my family. For the past five years, I’ve selected the HMO plan offering through my employer, but I’ve had a few recent life changes — I recently got married, and we are trying to start a family. I’m trying to understand whether I should make a change in plans, but there’s so many acronyms when it comes to health insurance. What are the differences between plans?

Here are the most common types of health plans:

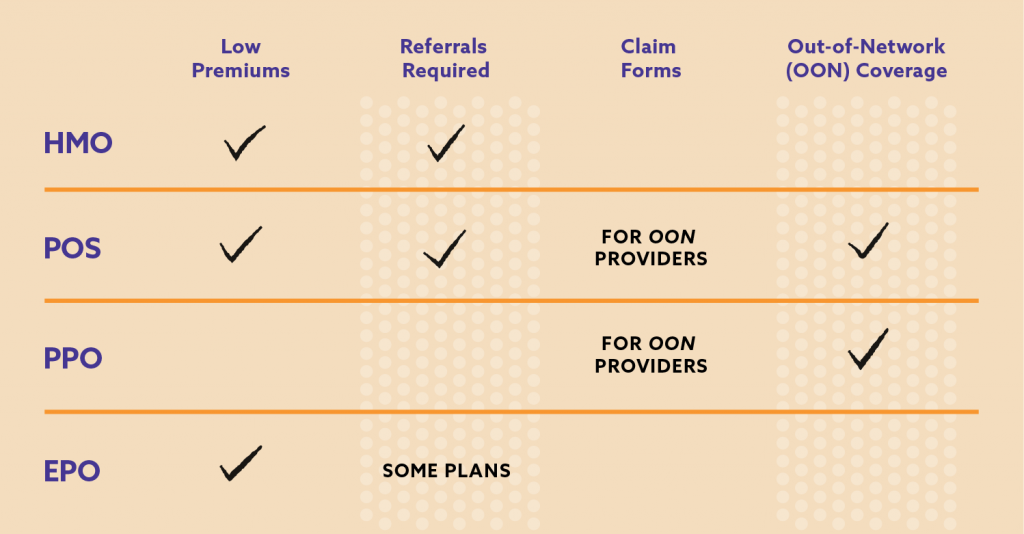

HMO: A Health Maintenance Organization, or HMO, provides employers or groups a way to take care of all their employees’ or members health care needs with reduced costs by negotiating with specific doctors, hospitals, and clinics. These specific providers must be used by the employee for the reduced fees to be provided to their medical insurance plan. In an HMO plan, you have the least flexibility but will likely have the easiest claims experiences since the network takes care of putting in the claims for you.

PPO: A Preferred Provider Organization, or PPO, offers reduced costs to members billed to their health insurance plan. Employees or members can choose the provider they want to see instead of being solely restricted to the HMO providers. A member can choose between a participating, or in-network provider or non-participating, or out-of-network (OON), provider.

POS: With a Point of Service plan, or POS, members can choose their own primary care provider (PCP) that has previously agreed to provide services at a discounted fee. In a POS the member would have to use the chosen PCP as a gateway first before moving on to a specialist in order to receive in-network benefits. In other words, whenever the employee would have a medical issue, the POS primary care provider must be contacted first in order to obtain the most benefit from the health insurance plan. In a POS plan, a member may choose to go out of network and pay a higher cost share.

EPO: With an Exclusive Provider Network, or EPO, the employee or member of the plan can choose from the providers within the network and do not have to have to work with a PCP. However, any service taken outside of the network may not be covered at all.

You can also check and compare available Harvard Pilgrim Health plans here.

Great job on your diligence in questioning whether your coverage will still fit your evolving needs! These needs can change from year to year, so re-evaluating your plan choice during an open enrollment period (or even during an event that would trigger a special enrollment period, such as your upcoming marriage), is always a smart decision. From setting healthier habits, understanding and maximizing your family health insurance benefits, and preparing for potential health changes (or challenges) you may face, there are plenty of opportunities to stay ahead of your loved ones’ health needs so you’re ready to take on anything.

And – if your coverage is through Harvard Pilgrim Health Care, you might be eligible for the Decision Doc tool, powered by HYKE, which provides plan selection support.